The anatomy of inflections

Inflection theory, contextual awareness and time resolution to build iconic companies.

The venture industry is going through a transformational phase. After two decades of funding incrementalism in a "software is eating the world" paradigm we got used to mis-labelling enterprise SaaS, food delivery services and fintech as venture. We are seeing a mid 20th century science fiction renaissance altering life at a civilisational scale - spanning AI, future of compute, space and computational biology amongst others. Why is that happening now as opposed to the 1990s or 2050s? The answer has to do with scientific, technological, economic and geo political inflections. This post is an attempt to provide a basic framework of how to think about inflections and outlier companies built upon them. It will serve us as the foundation for open sourcing some of our research and tooling going forward.

Inflection theory

In mathematics, an inflection is where a curve changes its direction of bending. We called our firm that way because we believe that human progress is nothing but a continuous flow of inflections in a metaphorical sense.

A strategic inflection point is a time in the life of a business when its fundamentals are about to change. The change can mean an opportunity to rise to new heights. But it may just as likely signal the beginning of the end.

Andy Grove in his book Only the paranoid survive.

There have been other attempts of defining inflection points in a broader context than business strategy. For example in Pattern Breakers, Mike Maples Jr. & Peter Ziebelman systematically explore inflection theory as a framework to spot outlier ideas. Their TLDR; is that pattern breaking companies are rooted in (1) one or more inflections which led the founders to develop (2) a unique insight that is then manifested in (3) a product and scaled through (4) a movement. We will only look into 1-3 briefly but focus on inflections only. At Inflection (we created the firm long before the book came out btw) we apply parts of this framework amongst many other things to assess companies and drive our research.

Inflections

Inflections can be described as pronounced shifts in science, technology, culture or (geo) politics that hold the potential to change human behaviour at scale.

They are hard to see at the time of their arrival and very easy to spot in hindsight. Getting the timing right is existential for the creation of venture scale companies. If you're too early you end up with a science project (left). If you're too late you end up with intense competition and compressed margins (right). Most builders and venture investors are leaning towards the 'too early end of the spectrum'.

Ideally, inflections are not very obvious and consensus but nuanced or over-looked by most to build

Inflection examples:

Insights

Maples and Ziebelman go on to describe insights as a non obvious or contrarian truth harnessing one or multiple inflections to create a breakthrough product. They make the case for startups competing on being different, not better, faster or cheaper than incumbents. Changing the rules of the game to win.

Applying inflection theory to some companies:

As venture investors we might stumble upon some insights occasionally but our primary work is to spot inflections. Ideally the ones that are over-looked or under-estimated by most.

Products

Products in this context are manifestations of inflections and insights. Typically, in early stage startup land the first products don’t find product-market-fit and need various iterations, sometimes pivots. The companies innovating through them usually have been right about the underlying inflections and insights but wrong about the manifestation of them. A famous example is twitch, a company built on inflections around smartphone cameras and internet streaming becoming feasible but manifested in a first-person-infinite reality show called Justin TV.

With this basic framework in mind we can now look a little bit deeper into what inflections are and what makes them so tricky to spot for founders and venture investors alike.

Contextual awareness

The most powerful venture companies are rarely underpinned by just one inflection but by many. In their inspiring book Why Greatness cannot be planned (shout out to Alex Obadia from Flashbots for recommending it) AI researchers Kenneth O. Stanley and Joel Lehman think about it this way (strongly paraphrasing based on my flakey memory): all powerful ideas are already out there and want to be discovered. To reveal them we can use a tool called novelty search - an algorithm helping us to explore new frontiers in a serendipitous way. To understand what is novel we need a framework of reference because something can only be novel compared to something else, to something that already exists. Novelty cannot be defined for itself. The same applies to inflections - they never come alone and can only be spotted and understood in the context of what is today.

Matt Cohler from Benchmark put it this way:

Our job is not to see the future, it’s to see the present very clearly.

A wonderful illustration of the networked nature of inflections is the interactive tech tree from Calculating Empires. Watch the 5min audio tour, it's absolutely brilliant. (Shout out to Anton from Anytype who shared it with me).

Time resolution

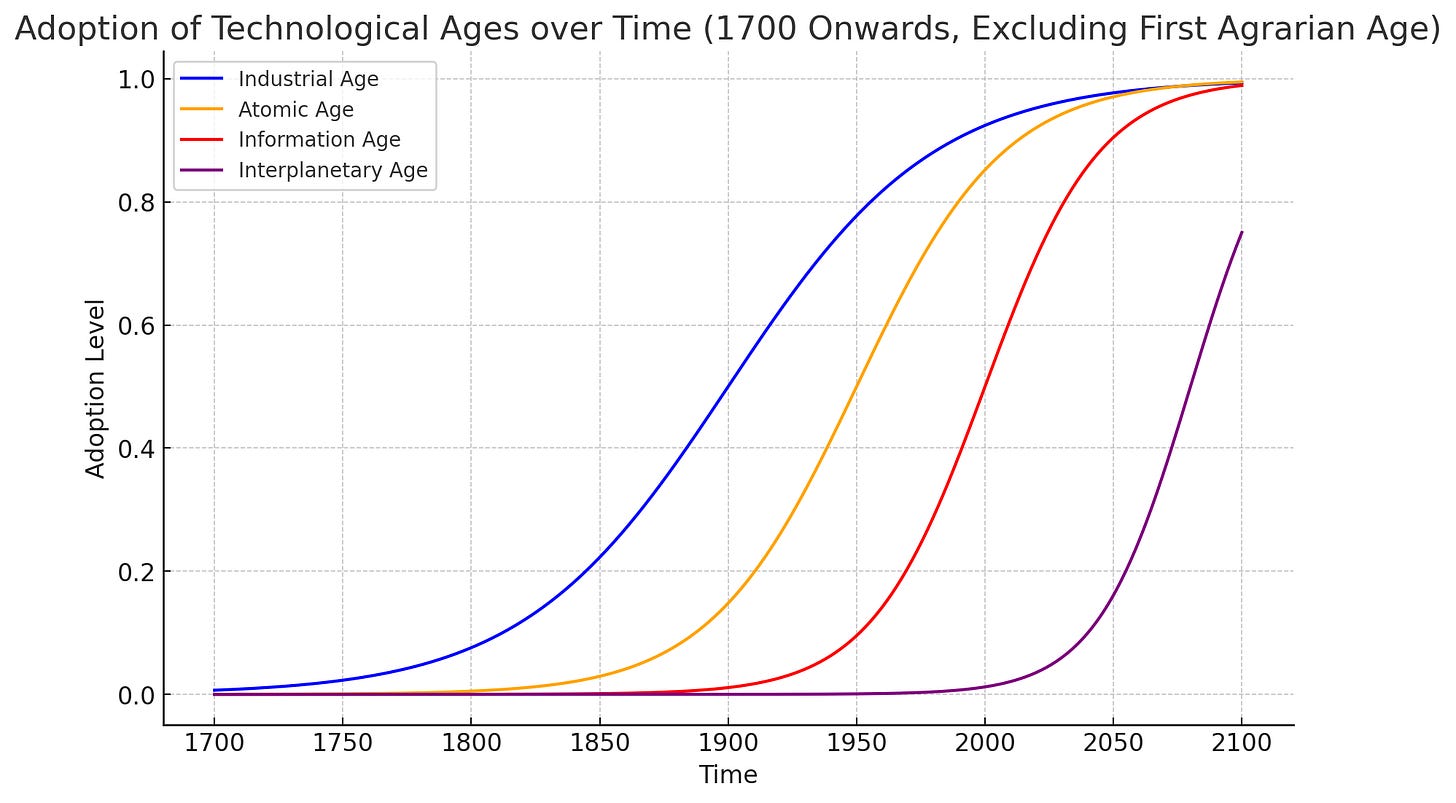

By nature, inflection's aren't dots. In Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages Carlota Perez established a model for disruptive innovations using S-Curves (left). Somewhat related Gartner (right) established a hype cycle model capturing similar ideas.

Those frameworks work pretty well to think through technology cycles. The right way to apply them would be to factor in time resolution. That is a tricky undertaking.

Let’s observe the facts: Humans took more than a hundred thousand Earth years to progress from the Hunter-Gatherer Age to the Agricultural Age. To get from the Agricultural Age to the Industrial Age took a few thousand Earth years. But to go from the Industrial Age to the Atomic Age took only two hundred Earth years. Thereafter, in only a few Earth decades, they entered the Information Age. This civilisation possesses the terrifying ability to accelerate their progress. On Trisolaris, of the more than two hundred civilisations, including our own, none has ever experienced such accelerating development.

Trisolarian scientist in Liu Cixin‘s 3 Body Problem

One might be right seeing inflections at the horizon early but that doesn't help to build a company with a 2-5 year time horizon to find product market fit if the inflection is too early in its s-curve journey. Often, crucial building blocks are still missing to unlock the next breakthrough. We couldn’t have built the first computers without electricity or light bulbs (none of which have been invented with computers in mind though). Many novel ideas explored by previous innovators have been directionally right but wrong in terms of timing: Henry Ford envisioned energy money to "substitute gold with units of energy to end wars" 100 years before Bitcoin was invented. In the 1830s the first electric cars were invented but never took off because of lacking battery density and price pressure from alternative design. The list goes on.

A simple analogy to think of is a microscope with variable resolution to look at inflections of different scale, moving on vastly different time scales. The charts are AI generated and very rule-of thumb to illustrate the idea, simplicity over nuance.

From here we could dive deeper to explore the inflections underpinning the development of the mobile web like e.g. broad band connections, small and powerful enough chips and batteries to power them amongst many other things. You get the idea.

Conclusion

To start (or fund) a company rooted in non-obvious inflections and unique, contrarian insights requires the right intuition with regards to time resolution and contextual awareness. Figuring them out by studying history and observing what is today will be time and energy well spent. We are looking forward to open sourcing some of our work on that soon and cannot wait to collaborate on it with you.