Venture's consolidation and the case for emerging managers

Consolidating over-heated markets; the risks of long term over-concentration; why emerging managers uphold idea meritocracy and outsized returns for LPs

The venture apocalypse is upon us. Only two funds raised 44% of the venture money in the US in 2024. The cash amounts deployed against emerging managers (firms with less than three funds) relative to more established firms dropped from 19% in the 2010 to 2020 periode to 16% and falling. Lux Capital's predictions of 30-50% of emerging managers ceasing to exist over the next couple of years are over-shadowed only by claims of an outright extinction of venture capital.

This post intends sheds some light on the long term trends in venture capital market concentration before making the case for emerging managers to uphold innovation. We are talking our own book here but we are right and here is why:

What are we talking about?

The above discussion refers to two related phenomena: market consolidation is the process in which companies in a particular industry merge or exit the market. It occurs in times of upheaval - recessions, conflicts, crisis - or as a result of over-heated markets. Market concentration on the other hand refers to the extent to which a small number of firms dominate a market with reduced competition. Concentration can be the result of a consolidation period and is expressed through the HHI (Herfindahl-Hirschman Index) or concentration ratios . The tricky part is to define what exactly constitutes a market in terms of products / services and geographies. Considerations around substitutability of a product or service and price elasticity are key factors, see SSNIP test for details.

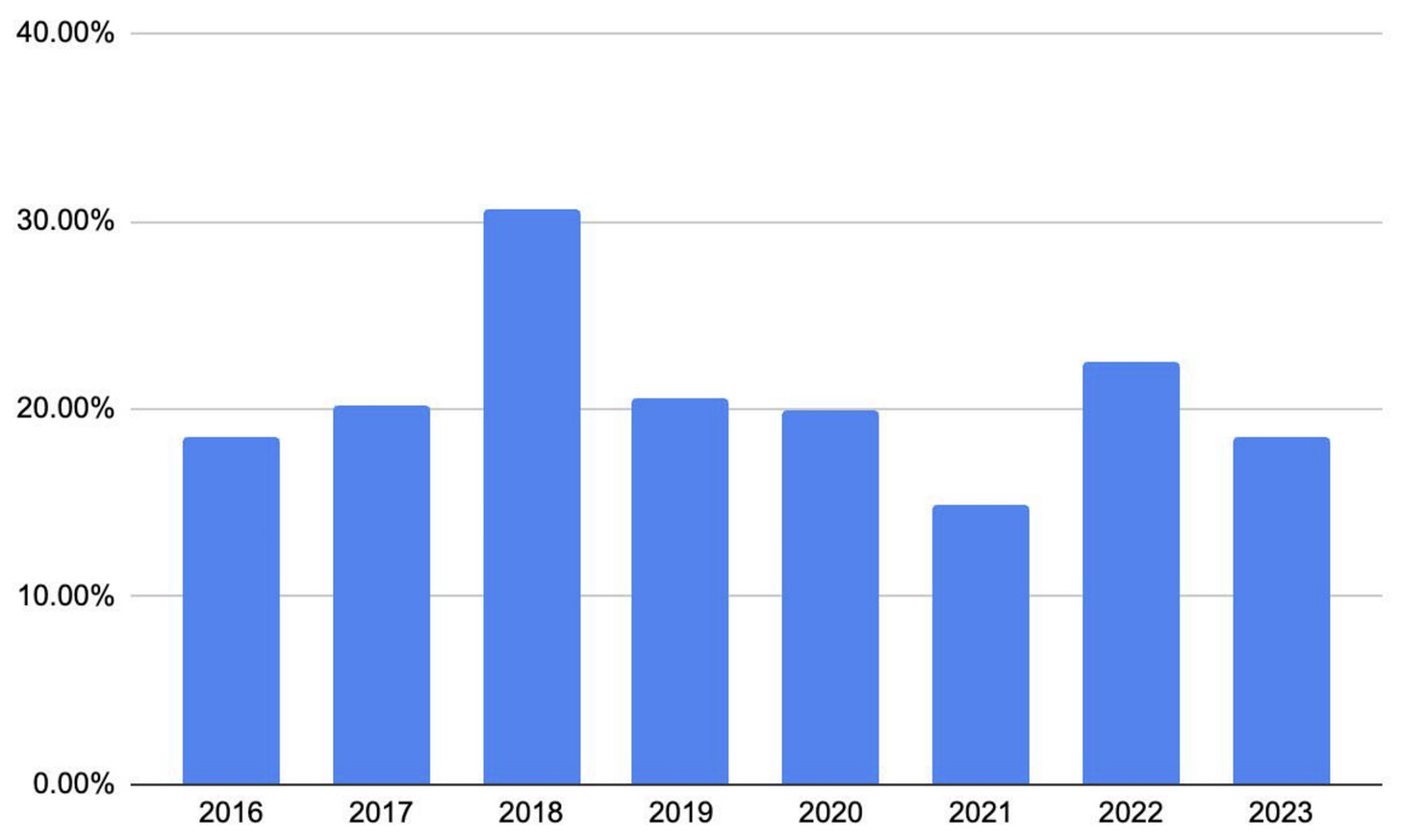

The top 5 concentration ratio in terms of 'funds raised' (US markets only) didn't change much since 2016 and has been hovering around the 30% mark what would be comparatively low if benchmarked against other industries. Be aware that the data below references the entire US venture industry - geographical and stage splits would paint a different situation. Especially early stage funding sources are much more fragmented than later stage ones.

Other metrics helping us to grasp the level of concentration in venture might be the relative (1) and absolute (2) share of emerging manager funds raised over time as well as fund count.

Now that we see the bigger picture it becomes clear that emerging managers won't disappear tomorrow and that many of the click-bait headlines and claims above are unrealistic. Yet, the multi decade trend towards market concentration is clear.

Drivers and effects of market concentration

What are the main drivers leading to high concentration and how does concentration affect markets?

Drivers: As discussed above phases of consolidation are an input for the level of market concentration - often driven by externalities (crisis, recessions etc.). Looking at much larger time windows though mere phases of consolidation aren't a sufficient explanation. There must be more powerful forces at play, such as: (1) economies of scale: Large firms can produce at lower average costs, making it difficult for smaller competitors to match their pricing and efficiency, (2) (data) network effects: where the value of a product increases with more users a few firms tend to dominate (social media, AI, telecommunication), (3) capital or asset accumulation: concentrating through M&A by merging with competitors, (4) distribution power: Control over key distribution channels can limit competitors' ability to reach consumers effectively, increasing concentration and (5) globalisation and market integration: Larger firms benefit from globalization by spreading fixed costs across international markets, which can lead to increased concentration in domestic markets.

Those drivers are hitting industries across the board: There are several studies indicating increased concentration across a large number of industries in the US - pharmaceuticals, agriculture, airlines, personal compute devices and the list goes on. Concentration increased in over 75 percent of U.S. industries since the late 1990s.

Effects: Let's take a look at the effects of market concentration. Following consensus views the outcomes are (1) less innovation, (2) worse products at higher costs and (3) wage suppression, (4) regulatory capture and (5) higher barriers to entry for newcomers.

Applied to the venture capital industry many stakeholder would be affected should concentration levels rise to the extreme:

1/ Many emerging managers will be washed out the ecosystem through this wave of consolidation. And that is necessary as well as healthy. The last few years in venture have been outliers - excessive volumes have been raised and deployed in record time without producing much value. Seeing the days of 'easy VC' and the 'venture playbook' come to an end means a fresh start, a clearing the air event for the industry. A net positive.

However, if the pendulum swings too far and the consolidation trend accelerates mid and long term the effects will be more negative:

2/ Founders would have less choice in picking their capital partners. If growth and pre IPO stages were dominated by only a handful of funds competition would fade in every category as large funds typically don't take conflicting positions (conflicts of interest).

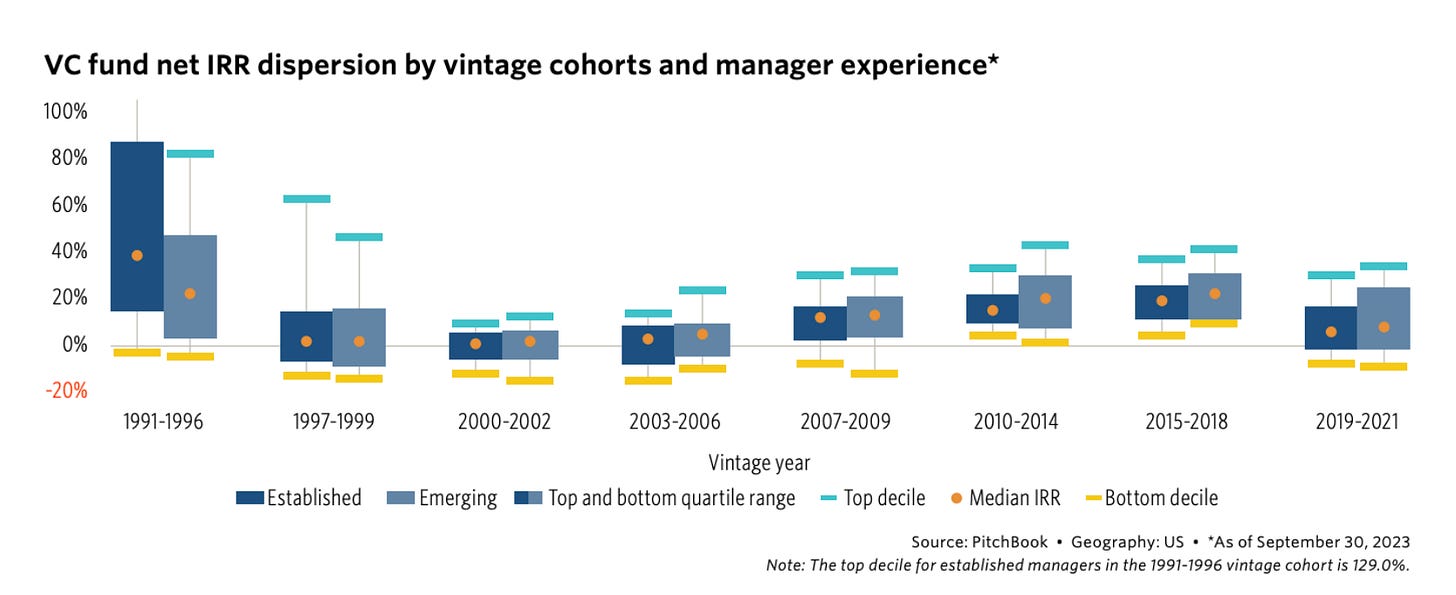

3/ Limited partners would be limited in their choices as access to large funds is typically more restricted than access to emerging managers. Further, larger funds come with very different risk-reward ratios and expected return multiples. Since the early 1990s emerging fund managers have mostly been outperforming established funds - by IRR and TVPI metrics.

The median return of emerging fund portfolios slightly exceeded that of their established counterparts, while the top-quartile figure delivered by emerging managers significantly outperformed. The pattern speaks to the ability of emerging managers to generate outsized returns while the spectrum of returns is wider and therefore performance is less predictable.

Within both the established and emerging manager groups, specialists outperform their generalist peers:

4/ The public and civilisation at large have an interest in seeing the most powerful ideas being funded to push the boundaries of the human race. Philanthropists and public money sources are attracted by the venture industry for good reason. Most breakthrough ideas are controversial, hard to spot and non-consensus. In a highly concentrated venture ecosystem dominated by large funds and their 15 people investment committees such seemingly alien and weird ideas wouldn't be funded - reversion to the mean. It would slow down human progress.

How to limit unhealthy market concentration?

Fighting concentration in any industry is like fighting gravity. However, there are a few things stakeholders could undertake to limit concentration down the line.

Show me the incentives and I will show you the outcome.

Charlie Munger

1/ Regulation: The debate on wether or not there should be political correctives to uphold more competitive markets is as old as the industrial age. The first anti trust laws root back to the Sherman Act in 1890.

The libertarian camp argues that if concentration drives down innovation and increases prices the incentives for newcomers are compounding to unlock a disruptive new way of doing things. Just wait for the invisible hand to do its magic. Famous examples are Tesla in automotive, AirBnB in hospitality, Anduril in defence, SpaceX in space etc. This narrative is flawed because it does not lead to less concentration but more once the new kids on the block built up their next generation monopolies.

The nanny state camp argues for governmental interference through tools such as merger regulation, restriction of agreements that distort competition or collusive behaviours and the prevention of dominant market position abuse. The current tools of anti trust regulators. This narrative is idealistic as none of such tools effectively prevented hyper concentration in any market (as the data and reports above indicate) due to an endless game of whac-a-mole driven by comparatively new phenomena like cross market network effects in social media for example (nobody saw it coming when Meta was allowed to acquire Instagram and What's App?).

2/ LP decision making: If LPs came to their senses and overcame the irrational bias of preferring [big name fund] exposure over emerging manager exposure because of lowered risk perception the ecosystem would be in a better place.

3/ Founder decision making: If founders were to run a diligence process on the fund they are about to collaborate with they might find that emerging funds - especially in early stages - have much better incentive alignment and as they need to prove themselves are more likely to put down the necessary leg work.

4/ Emerging manager collaboration: collectively, emerging managers could start to collaborating closer to achieve some economies of scale. Shared back office infrastructure, software or services might be a starting point to improve unit economics in venture. Especially complementary micro funds might significantly benefit from closer collaboration from sharing research, dealflow or LP access amongst many other things. But this is stuff for another post.