Rebuilding Finance

How the open source developer community is building an alternative financial system. Open finance, Defi, open source, crypto networks vs. FinCen, Wirecard, QE unlimited.

Our financial system and its institutions are deeply flawed. Open ledgers and smart contracts provide us with the opportunity to build an internet native financial system from scratch with very different properties underpinned by open source design principles. This post explores its core value propositions and shortcomings.

Status Quo

Our monetary and financial systems rely on institutions such as (central) banks and governments backed by the state's monopoly on violence. These institutions extended their powers over decades now peaking in quantitative easing unlimited and a tightly knit system of surveillance, financial exclusion and corruption at global scale.

HSBC aiding drug loards and terrorists , the Danske Bank money laundering scandal, the wirecard debacle or the FinCen leak are just the tip of the iceberg. These events aren't the exception they are an expression of deep, systemic flaws. It should have become obvious that financial surveillance and de-platforming in the form of KYC, AML / CTF isn't just inefficient to combat crime but incredibly harmful for open societies.

It is inefficient because it tries to regulate a tool as opposed to the actual criminal act. It creates incentives in a way that corrupts bankers, politicians and regulators. In the light of FinCen there will be requests for even stricter regulations but doing more of something that clearly didn't work in the past, won't make it work in the future. It won't stop people from committing crimes. Stricter regulations will only cement the banking industry's oligopolistic market structures further. It stifles innovation.

It is harmful for open societies because it cuts off billions of people from financial services robbing them of their economic opportunities. The current system serves as a tool to cement power. It undermines the democratic process and paves the way for despotism. The good news is - an alternative system is under heavy development.

Open Finance

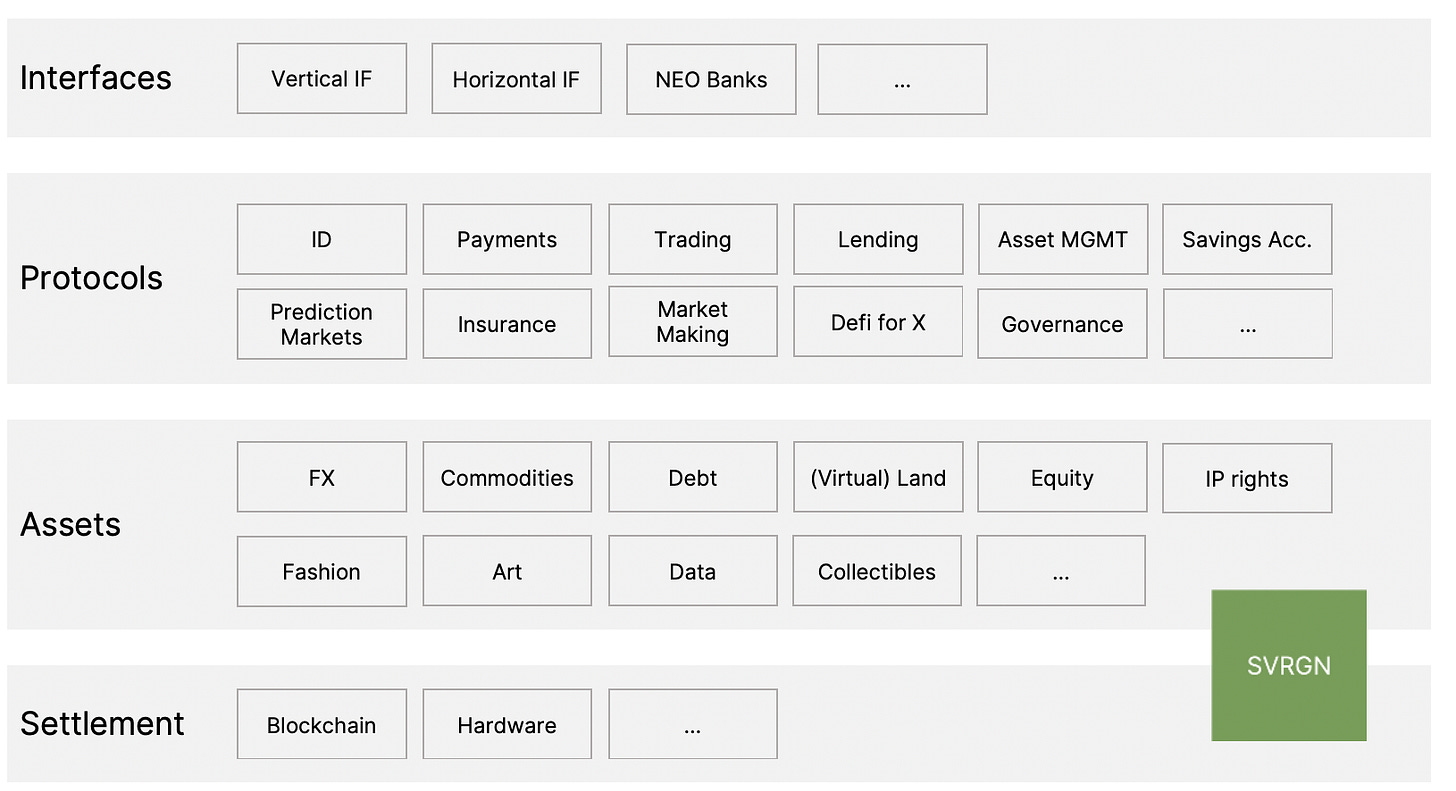

Open finance or Defi (decentralised finance) is used as an umbrella term used to describe an internet native financial system that is built on open ledgers and which is owned by its stakeholders and contributors instead of governments or corporations. It consists of a highly modular and composable stack of technologies and coordinates work, resources and capital at global scale.

Our generation has the opportunity to create an internet native financial system that is 100x more inclusive, user centric, adaptive, cost efficient and functional than its predecessors.

Inclusive

Public blockchains can be referred to as multi client data bases every user can read and write into without limitations. This shared data base can be accessed through an API that comes with strong guarantees such transparency (everyone can see the open source code base) and immutability (it either cannot be changed or it can only be changed through a transparent and stakeholder driven, public governance process). Just like information is flowing through the web we are now seeing digitally scarce objects like cryptocurrencies, crypto assets and digital representations of various items flow freely around the globe, 24/7. The software native nature combined with vastly distributed ownership stakes and the absence of any corporation or other physical roots make these networks very hard to regulate. Instead, regulation can only occur at the very fringes of crypto networks like interfaces (if build as a company) or application specific hardware providers e.g. All of these aspects guarantee a comparatively high degree of accessibility for everyone with an internet connection.

User centric

Today's financial ledgers are controlled and maintained by corporations or political institutions with their own interests. In Defi users are controlling their assets directly through public private key encryption - they are literally holding the keys to their data, money and financial assets. The pseudonymous or in some cases even completely privacy preserving (Zcash) and thereby more secure architecture of crypto networks makes it much harder for an aggressor to seize assets. Marginalising minorities by cutting them off of the veins of the financial system becomes nearly impossible. Imagine the jews and other marginalised communities who suffered under the Nazi regime could have stored their knowledge and financial assets in their heads by memorising a passphrase. The barriers to leave a country are significantly lowered. Crypto networks are permission-less and censorship resistant.

As crypto networks are based on open source code, any network can be forked and implemented differently any time. Despite strong network effects around liquidity, trusted brands and the broader embedded ecosystem, crypto networks will likely be monopoly resistant. Whenever a network becomes exploitative and predatory against the interests of its users or stakeholders economic pressure will rise. In a global, open market place for settlement and various financial services the market mechanism will find non monopolistic equilibria benefiting all stakeholders and users.

Adaptive

Open source governance enabled by software makes crypto networks much more adaptive than the legacy system. Crypto networks can be seen as free market public infrastructure that is governed by its stakeholders and users. Through incentive games which can be implemented, tested and iterated over at very low costs (crypto economics) new governance mechanisms like futarchy, quadratic voting or even digitally native social contract templates and court systems (Aragon) are explored in the wild. Bringing together open source principles with iterative development practices in the context of governance and policy making holds the potential for humanity to adapt to global existential threats. Crypto-economics is a vast and multi disciplinary design space. Free market competition (see above) serves as the governance mechanism of last resort as users and stakeholders can always opt out of a network to join or create another one through forking.

Cost efficient

Without the need for centrally coordinating institutions the costs of issuing, storing and protecting virtual assets can be significantly lowered. Global settlement becomes available within seconds for all assets that are represented on chain, not just money.

Relationships between individuals, companies, assets or any other object - think a business or social graph - become a public good. Just like the ledgers themselves, these information graphs can be publicly accessed by everyone with an internet connection. Depending on context an object's metadata can be me made transparent or it can be selectively revealed to a defined number of actors, e.g. counterparties. The concept of open data graphs empowers humanity to transact pseudonymously over the internet without relying on third parties or taking any counterparty risks. Financial and commercial contracts can be standardised and their underlying mechanics can be publicly verified. They are self executing. No lawyers or courts needed.

As the existence and ownership of financial assets can be cryptographically verified there is less room for financial fraud in the form of false accounting (wirecard), corruption (FinCen) or complex nested financial products (2008 crisis).

Functional

Based on a system of interoperable ledgers financial and data assets become composable. Just like lego blocks or music samples can be used to create castles or songs - Defi's money legos empower developers to create new financial services driving innovation and utility in various fields. Programmatic lending (Maker, Compound), supply chain financing (Centrifuge) automated market making (Balancer, Uniswap), programmatic insurance (Nexus, Opyn, Potion) and unified interfaces (debank, zerion) are upgrading conventional financial services. Beyond that open financial primitives underpin new forms of virtual art (Foundation, SuperRare), IP rights (Molecule, Audius), virtual reality (Decentraland, Cryptovoxels) or content creation and distribution with transparent, user centric incentives (Erasure, Relevant). Prediction markets which let the world bet on any future events to create a probability weighted outlook into the future (Augur, Reality Cards) might turn into an almighty oracle serving everyone, driven by incentives. And the list will go on...

If open finance does not materialise its potential - why?

The open finance stack is still in its infancy and there are various risk factors at play which might limit its success on many levels.

Not crossing the chasm

Currently, about 150k users are bootstrapping (and speculating) the ecosystem into existence. It still looks like a toy. The UX is still clunky and scares off mainstream users. Many projects are operating in regulatory grey areas and value capture as well as business model innovation is overall experimental preventing more institutional investors to get involved. Many actors in finance are benefiting from the current system, hence they are not incentivised to create an alternative. The same applies to established institutions which are expected to push back as hard as they can - just like the church pushed back on the printing press. Big tech corporations and governments will try to compete with open finance services always at the cost of centralised control.

Technical limitations

Bitcoin's scripting language is very limited and only allows for simple multi signature schemes. Ethereum allows for more arbitrary computations but is operating at capacity limits. Layer 2 scaling solutions are under heavy development and so are alternative, sovereign chains coming with their own tradeoffs. Once these infrastructural barriers are overcome the open finance stack will still be challenged where the old systems need to connect with the new ones (physical assets) or where human intervention is still essential - crypto networks and assets are for machines. While composability and interoperability are increasing utility and create strong network effects they also create a system of severe interdependencies - if one lego block falls, the whole building might collapse. Open source development and extensive testing are mitigating such risks but they won't be zero.

Conclusion

The opportunity to create an internet native financial system and with it a new set of open source institutions is gigantic in scope and impact. We are early in the development cycle but many obstacles have been overcome already and the pace of innovation is accelerating. Within this century humanity will upgrade its collective decision making platform once more leaving behind the concept of nation states eventually.