In a world where the geopolitical landscape is shifting at an unprecedented rate, Europe finds itself at a crossroads. The continent is grappling with a multitude of challenges, from the erosion of democratic values to the urgent need for technological innovation in defense. One emerging player making waves in this space is 201 Ventures, led by Eric Slesinger, who organized the European Defense Tech Summit in Madrid. In this article I try to share some of the observations and learnings.

The Catalysts for Change

The Geopolitical Landscape

Europe is facing a drastically different geopolitical environment than just a few years ago. Events like the Cambridge Analytica scandal in 2016, Russia's invasion of Ukraine in 2022, and the recent invasion of Hamas into Israel in 2023 have served as a long-coming wake-up call. The message is clear: Europe might have to fight for democracy. Finland joining NATO and Sweden finally deciding to apply for membership in spite of long-standing public opposition (recent shift) are additional signs of the threat of violence and oppression being taken seriously.

At the same time, Europe is wrestling with a disparity between its values, actions, and what are the facts. Europe should mean progress, democracy and union, in the face of war, as it was started in the wake of WWII. While the EU leads the way on regulation, it severely lags behind when it comes to public support for innovation. The continent, often seen as the face of unified democracy and functioning welfare states, has amassed more bureaucracy than functioning paths to novel tech. This has led to calls for strengthening political support for innovation in industry (Handelsblatt article). This is certainly true for deep tech, as well as for defense tech.

Increased appetite for dual-use in venture

What became very clear when looking around the room in Madrid, was the amount of VCs and later stage investors who seemed very open to investing in defense applications. Though, almost exclusively as long as it is “dual-use”. Dual-use tech means that the companies and technologies serve both civilian and military applications. As highlighted on stage at the summit by Andrea Traversone, MD at the recently founded NATO Innovation Fund: “There is one example of a dual-use company that pivoted from military applications to civilian” - an Italian bullet maker that switched from military to sport shooting applications. Or, inversely, the norm is that a company which a “dual-use” fund invested into would decide to go after defense applications as a secondary GTM strategy.

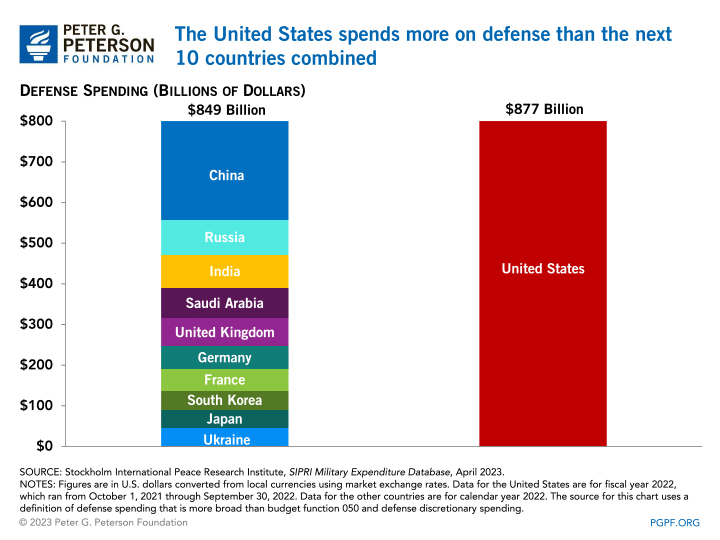

Overall the increased willingness to engage with the sector by generalist investors can be observed since 20 years, when Palantir started, and later when Anduril became a hit. Yet, most objections still stand: selling to governments means long sales cycles, chunked income and a strong preference for incumbents. This is changing to some degree with tech outreach coming from the European agencies themselves, but there is simply no competing with the U.S. defense budget.

The rise of American Dynamism by a16z highlights numerous national interest-aligned technologies such as energy, satellites, drones and bio-engineering. The European Dynamism movement is yet to crystallize, but may be guided by the recent movement by the EU towards sovereignty. It’s somewhat ironic that European defense investors to a large degree still are more hesitant to invest in European defense companies than U.S. VCs.

€160 Billion for critical technology development in the EU

The recently launched €160B program “Strategic Technologies for Europe Platform” highlights six key enabling technologies for the sovereignty of the European Union. Among them are advanced (nano)materials, manufacturing, AI and semiconductors to name a few. The hundreds of billions of euros can be used to recreate success stories such as “Made in China 2025” and fill the noted gap in funding at graduation from startup but the exact spending is still unclear.

The verdict of an assessment of these key technologies in the EU is: in spite of effort and commitments, Europe is losing ground. We’re dependent on suppliers of raw materials, talent and knowledge, and we lack the proper paths to commercialization. Pretty grim.

Somewhat reflective of the European situation was the fact that the organizer, Eric, is an American, and many of the other prominent speakers were as well, such as the CTO of the CIA. The US has a rich history of funding deep technology with strategic relevance, e.g., DARPA notably incubating the internet. The venture arm of the CIA, In-Q-Tel, also made a memorable appearance at the summit in a discussion on how to ensure alignment of technology to national interests.

The Customers: A Paradigm Shift

European governments, agencies, and services are increasingly recognizing the importance of technology. The recent experiences of battle on the cyber- and physical battlefield has caused the economic scare of China overtaking a struggling manufacturing industry to turn into a scare that the technological advantage may be lost as well. Palantir and Anduril have gone from the scary companies that may or may not have contributed to the capture of OBL (rumors unconfirmed but not refuted to the joy of the PR departments), to now role models in the market for defense contractors.

The customers are primed since a longer time to understand that the battlefield is driven by technological advantages, such as chips for strategic bomb targeting, secure communications, and the use of drones. However, these customers are often too slow-moving to also be developing the tech and research, leading to a need for new collaboration models. As Nand Mulchandani, CTO of CIA, said in a video call: “We don’t want to have to invent the tech, we just want to buy it and apply it!”

In a panel on the use of drones in warfare, the Dep. Minister of Digital Transformation of Ukraine, Alex Bornyakov, explained how the transfer of technology in the private sector to public was overhauled at the beginning of the invasion. Previously, there was an upper limit to the margins that a defense contractor was allowed to make in Ukraine. A limit of 1%! This led to basically only incumbents being able to supply the government. The demands of the Ukraine defense weren’t covered! Soldiers bought off-the-shelf drones and 3D-printed custom parts to retrofit them for battle. Now the margin limits have been increased and a multitude of new funding programs have led to over 700 unique Ukrainian suppliers to the local defense have popped up. The public customers and private technology innovation are in sync, but only because of the dire situation.

The operating system of government procurement is confirmed by a former military intelligence officer of a Northern European country I spoke to.

The goal is to make 100% certain that the systems are secure, even if it takes years to get there. Whereas Ukraine, with hubs such as Brave 1, built so much with very little that is achieving its goals within the current battle.

He also highlighted how certain states tried to replicate the success with initiatives like the Cyber Innovation Hub in Germany and the military innovation program in Sweden, but remain skeptical of their impact.

The Scope of Tech: Beyond Drones

By far the hottest tech topic at the European Defense Tech Summit was drones. The Auterion CEO sees the future of battle drones as drone dog fights, with massive swarms (armies?) of drones being coordinated from a distance or autonomously. This will require highly advanced compute capabilities and massive amounts of data processing on the edge. Quantum systems build aerial surveillance drones, while Alpine eagle and another stealth startup (all three out of Munich) provide counter-drone technology. Defending yourself against attack drones is a truly frightening (Hitchcock’s The Birds, anyone?) thought.

However, the scope of technology in defense is incredibly wide. From bullets to sub-nautical communications and quantum computing, the field is expansive. What I would have liked to see more discussed this time around, were topics like cyber defense of critical infrastructure and more focus on deeper tech like advanced materials, resilient manufacturing and energy grid technologies. I was very pleasantly surprised to meet a number of super-computing and semiconductor startups, who have clearly understood their own strategic importance to Europe.

Even though there was a gentleman from a UK ministry present, there was a lack of discussion around commercialization support from European states, and few representatives (as far as I could tell) from the public sector. The funding paths may exist, but they should be de-bureaucratized and made transparent in outreach through more events like the European Defense Tech Summit.

Thanks again, Eric for pulling this off and gathering the impressive people you did.

Thanks. nice article Jonatan.

What do you mean by this specifically? 'The funding paths may exist, but they should be de-bureaucratized'